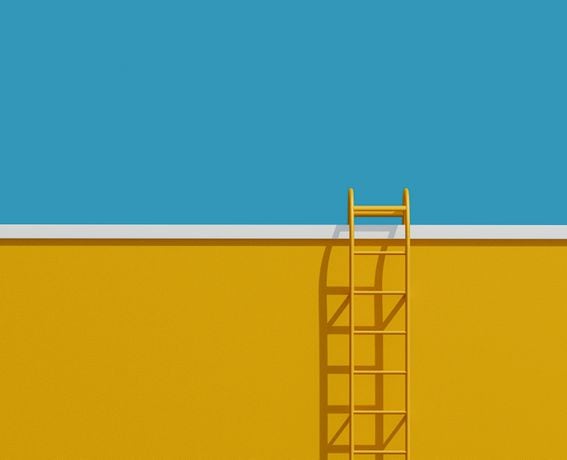

As the U.S. edges closer to election day, its digital asset regulatory landscape remains mired in ambiguity. Regardless of who wins, 2025 will bring regulatory shifts that investors must prepare for.The recent World Economic Forum (WEF) report on global approaches to crypto regulation highlights the U.S.’s reliance on enforcement rather than clear policy, complicating growth and innovation, especially as compared to the EU’s structured MiCA (Markets in Crypto-Assets) framework which gives investors a regional roadmap for engagement. Regulatory uncertainty is particularly critical for decentralized finance (DeFi), where the U.S.’s aggressive enforcement strategy has resulted in chilling effects on innovation. For example, the SEC’s recent closure of its probe into ConsenSys without filing charges, while a short term win for Ethereum-based DeFi projects, underscores the lack of regulatory consistency.UnmuteBitcoin Jumps Above $67K to Nearly a Three-Month High02:04Tesla Is Moving Bitcoin; Trump-Supported Token Falls Flat11:08MoneyGram Announces Its Latest: MoneyGram Wallet01:31Bitcoin ETFs Are "Trojan Horse for Adoption": Bernstein02:28Trump Pumps DeFi Token Sale; Bitcoin Price Jumps Above $65KYou’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.This uncertainty is creating opportunity as well as risk, as traditional financial (TradFi) institutions ramp up their entry into digital assets. TradFi firm’s sophisticated regulatory strategies, honed over decades of navigating complex compliance environments, are better positioned than smaller crypto-native companies. As major players launch products like Bitcoin ETFs and tokenized funds, innovators without regulatory expertise may be squeezed out unless they adapt to emerging frameworks such as those proposed by the Stablecoin Standard, which offers voluntary requirements for transparency, operational resilience, and reserve-backing. This model could offer a path for other innovators to meet compliance expectations and accelerate growth and adoption.For institutional investors, a strategic approach is crucial. Using a “regulatory ladder” framework, similar to a fixed-income ladder, can balance risk and opportunity across different asset profiles:New TradFi entrants: Bitcoin ETFs and tokenized funds that have demonstrated regulatory compliance.Payment processing innovations: Consider regulated stablecoins or other payment-related projects with transparent reserves and governance as seen in New York’s regulated stablecoins like Paxos and GMO-Z.com Trust.Innovators: Allocate to high-potential, early-stage blockchain projects that are equipped to navigate shifting compliance requirements.With potential regulatory shifts on the horizon regardless of election outcomes, investors should prepare diversified crypto portfolios that include both TradFi and nimble innovators backed by thoughtful regulatory strategies. Ultimately, as the WEF highlights, the U.S. must eventually reconcile its enforcement-first approach or risk losing its competitiveness to more progressive regulatory regimes in the EU and Asia.Note: The views expressed in this column are those of the author and do not necessarily reflect those of Crypto, Inc. or its owners and affiliates.Edited by Alexandra Levis.