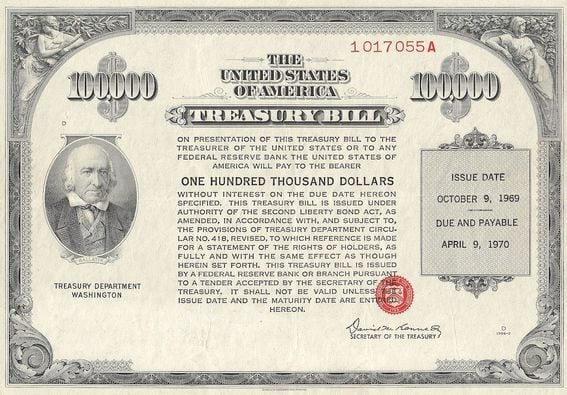

Imagine a token that denotes ownership in a money-market fund, works like a yield-bearing stablecoin and can also be posted as collateral for trades. That’s where U.K. investment firm abrdn and regulated exchange Archax are in the race to tokenize traditional assets.Archax, one of the first crypto firms to be regulated by the Financial Conduct Authority (FCA), and abrdn, with $626 billion of assets under management, went live with an institutional-grade money-market fund token back in October. The two are now putting it to use, lining up customers looking for new and flexible ways to allocate capital.

大型金融公司意识到,通过在区块链上代表资产,可以实现一系列运营效率和成本节约的效益,但很少有公司能够走出概念测试阶段。Archax是FCA监管的早期加密公司之一,而abrdn则拥有6260亿美元的资产管理规模,他们在去年10月推出了一个机构级别的货币市场基金代币。两家公司现在开始利用它,吸引寻求新的灵活资金配置方式的客户。

Clients have to be onboarded, wallets have to be whitelisted, and the token is available only to professional investors, Simon Barnby, Archax’s chief marketing officer, said in an interview. But the tokenized tranche of the abrdn fund is available for as little as $5,000, potentially opening up the product to a new channel of investors.

Archax首席营销官西蒙·巴比(Simon Barnby)在接受采访时表示,客户必须完成注册,钱包必须列入白名单,代币仅供专业投资者使用。但abrdn基金的代币化部分最低可达5000美元,可能为新渠道的投资者打开产品。

“There’s about a $400 million pipeline of customers whose interest has been thoroughly piqued,” Barnby said. “We’re talking to a lot of payment firms, and a lot of people who are perhaps sitting on a stablecoin like USDC or USDT, which doesn’t generate any yield. In previous years, when interest rates were low, treasury functions of businesses were not so worried about where the money was and if it was generating any return. But now they want to put their assets to work.”

巴比表示:“大约有4亿美元的客户资金已经表现出浓厚的兴趣。我们正在与许多支付公司以及许多持有USDC或USDT等稳定币的人进行交流,这些稳定币没有产生任何收益。”在过去,当利率较低时,企业的财务部门并不太担心资金去向及是否有所回报。但现在他们希望让资产发挥作用。

The onset of a higher interest-rate environment is changing patterns of innovation. Not only is this accelerating tokenization plans focused on low-hanging fruit like treasury bonds, it’s also garnering a response from decentralized finance (DeFi), trending toward new models of yield-bearing stablecoins.

高利率环境的到来改变了创新模式。这不仅加速了以国债等低 hanging fruit 为重点的代币化计划,还引起了去中心化金融(DeFi)的回应,趋向于新模型的收益稳定币。

Early next year, Archax will introduce trading pairs of the abrdn money-market fund (MMF) token and bitcoin (BTC). In other words, rather than trading BTC against the U.S. dollar or USDC, users can trade bitcoin against U.S. dollar MMF tokens.

明年初,Archax将推出abrdn货币市场基金(MMF)代币和比特币(BTC)的交易对。换句话说,用户可以交易比特币兑美元MMF代币,而不是交易比特币兑美元或USDC。

“This is what happens in the DeFi world, where people borrow against assets, lend assets out,” Barnby said. “A token that represents ownership in the money-market fund could be used as collateral in an area like regulated DeFi, which is an area we’re looking at for next year.”

巴比表示:“这就是发生在DeFi世界中的事情,人们抵押资产,借出资产。代表货币市场基金所有权的代币可以作为抵押品在像受监管的DeFi这样的领域使用,这是我们明年要研究的领域。”

The somewhat diminished DeFi universe is interesting, but it’s just a speck on the landscape compared with the scale of traditional markets.

DeFi领域的发展虽然有些减缓,但与传统市场规模相比,它只是一个微不足道的存在。

Abrdn has a long pipeline of financial products to tokenize, the firm’s alternative investments leader Duncan Moir pointed out, but wanted to start out with “something straightforward,” where there’s already demand, with the expectation it would be for the crypto native investors.

abrdn的另类投资负责人邓肯·莫尔(Duncan Moir)指出,abrdn有一长串金融产品可以代币化,但希望从“一些简单的东西”开始,因为已经有需求,预计将面向加密原生投资者。

“Swap dealers accept money-market funds, so it could be used to post margin on a swap, for example,” Moir said. “Looking ahead, I’ll be interested to see if it can be used for settlement of tokenized securities. I can certainly imagine a future where there are other tokenized funds, and this as the cash asset you’re trading against makes a lot of sense.”

莫尔表示:“掉期交易商接受货币市场基金,因此它可以用于例如在掉期上进行保证金抵押。展望未来,我将有兴趣看到它是否可以用于结算代币化证券。我当然可以想象未来会有其他代币化基金,这作为你交易对手的现金资产是非常合理的。”

In conclusion, the emergence of tokenized traditional assets offers new opportunities for investors, especially in the intersection of traditional finance and decentralized finance. It also reflects the increasing demand for flexible and efficient capital allocation solutions in today’s market environment. As the industry continues to evolve, it will be crucial to navigate the regulatory landscape and ensure responsible and sustainable innovation.